Getting money from insurance claims has always been a bit of a headache. Dealing with tons of paperwork and waiting forever for things to get sorted out—it’s not fun, right? Traditional ways of handling insurance claims have taken a lot of heat for being show and confusing.

But guess what? In recent years, they brought in the superhero of technology – Artificial Intelligence (AI). This cool tech is here to rescue us from these long-standing issues. Today, let’s tag along with XClaim and break down these challenges in a way that’s quick and easy to understand.

Challenges Faced by Users in Traditional Insurance Claim Processes

As an insurance user, have you ever had to deal with these challenges in the traditional insurance claim process?

Too much paperwork: Sorting through a massive pile of documents can be confusing and lead to delays when trying to submit an insurance claim.

Extended processing times: Dealing with prolonged waits due to manual processing, especially when we need a quick resolution.

Concern about data accuracy: Even a small error while entering data can cause complications during the claim assessment.

Limited user interface: Unfriendly and challenging interfaces make the entire claim process confusing, resulting in a not-so-great user experience.

The emergence of AI Technology in Insurance Claims

In the modern era, the development of Artificial Intelligence (AI) has marked a significant leap forward in the insurance industry.

Facing the challenges of traditional claim processes, the insurance sector swiftly recognizes the innovative potential of this technology. AI tools have the power to revolutionize the insurance industry, tackling tasks such as claims processing, enhancing customer experience fraud detection, natural language processing, and insurance assessment.

Typically, the efficiency in claims processing significantly impacts customer decisions to renew insurance policies with the same insurance company.

Claims processing is a complex and time-consuming procedure within the insurance industry. One common form of compensation is hospital expense reimbursement, where the insurance company covers a portion or the entire medical cost for the patient during their hospital stay. This approach helps alleviate financial pressure on patients and their families during treatment.

Before the advent of direct billing services, manual claims processing took up to 14 days, significantly impacting the customer experience. Claims for hospital expense reimbursement typically involved dozens to hundreds of different documents related to inpatient/outpatient treatment, surgeries and examination referrals.

With the evolution of technology, the insurance industry is gradually transitioning to digitalization, embracing new technologies like artificial intelligence and automation. Optica; Character Recognition (OCR) technology has become a crucial tool, facilitating the swift processing of documents and promptly addressing compensation requests.

Automating Processes with AI

AI technology has played a crucial role in automating various aspects of the insurance process. From automatically identifying information in claim records to risk analysis, AI is opening a new world of efficiency and accuracy.

Efficient Data Analysis

The exceptional ability to process large amounts of data is a standout feature of AI. In insurance, it enables the analysis of diverse data from various sources, ranging from customer information to market trends, supporting strategic decision-making and risk pricing.

Enhancing Risk Prediction

AI also plays a significant role in enhancing risk prediction capabilities. From assessing risk factors to forecasting market trends, AI helps insurance companies make decisions based on accurate and detailed information.

Integration of OCR AI Technology

The integration of OCR AI (Optical Character Recognition) technology in the insurance process minimizes reliance on paperwork and manual procedures. This not only optimizes time but also ensures accuracy in data collection.

Building the Foundation for Modernization

The emergence of AI is not just an improvement in current performance but also the first step in the comprehensive modernization journey of the insurance industry. Companies are recognizing the strategic value of AI in ensuring flexibility, reliability, and adaptability to an increasingly dynamic market environment. The rise of AI is not just a transformation but an opportunity to build the future of the insurance industry.

In Vietnam, many independent insurance entities have taken the lead in integrating technology into their operations. This not only enhances professionalism but also improves the efficiency of the claims processing process. Specifically, they have succeeded in applying data analysis, automatically identifying information on patients’ documents, and digitizing essential information fields for storage in their systems.

Swift Insurance Claim Settlement with Xclaim

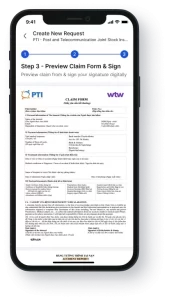

Xclaim, equipped with its automatic data extraction capabilities, brings forth several crucial advantages.

Quick and Efficient Insurance Claim Process

Xclaim significantly reduces the processing time for claims. The automation of data extraction eliminates manual steps, optimizing the time from receiving documents to a claim decision.

Minimized Errors and Inaccuracies

The automation feature of XClaim reduces the risk of data entry errors by humans, ensuring accuracy and avoiding issues stemming from human factors.

Improved User Interaction

The integration of XClaim not only optimizes the process but also creates a user-friendly interface, enhancing the overall experience for users participating in the claims process.

With these advantages, XClaim is not just a short-term solution for the current challenges in the insurance industry but also a significant step towards modernizing and optimizing the sector. The combination of automation technology and a focus on user experience demonstrates XClaim’s innovation and commitment to the future of the insurance industry.

Modernizing the insurance claims process is not just a trend but a necessity to meet the increasing demands of users in the digital age. With the support of Artificial Intelligence, we can easily envision a future where the claims process becomes flexible, rapid, and adds substantial value not only for users but also for the entire insurance industry.